Riding the Fintech Wave: A Deep Dive into India’s Financial Revolution in 2023-2024

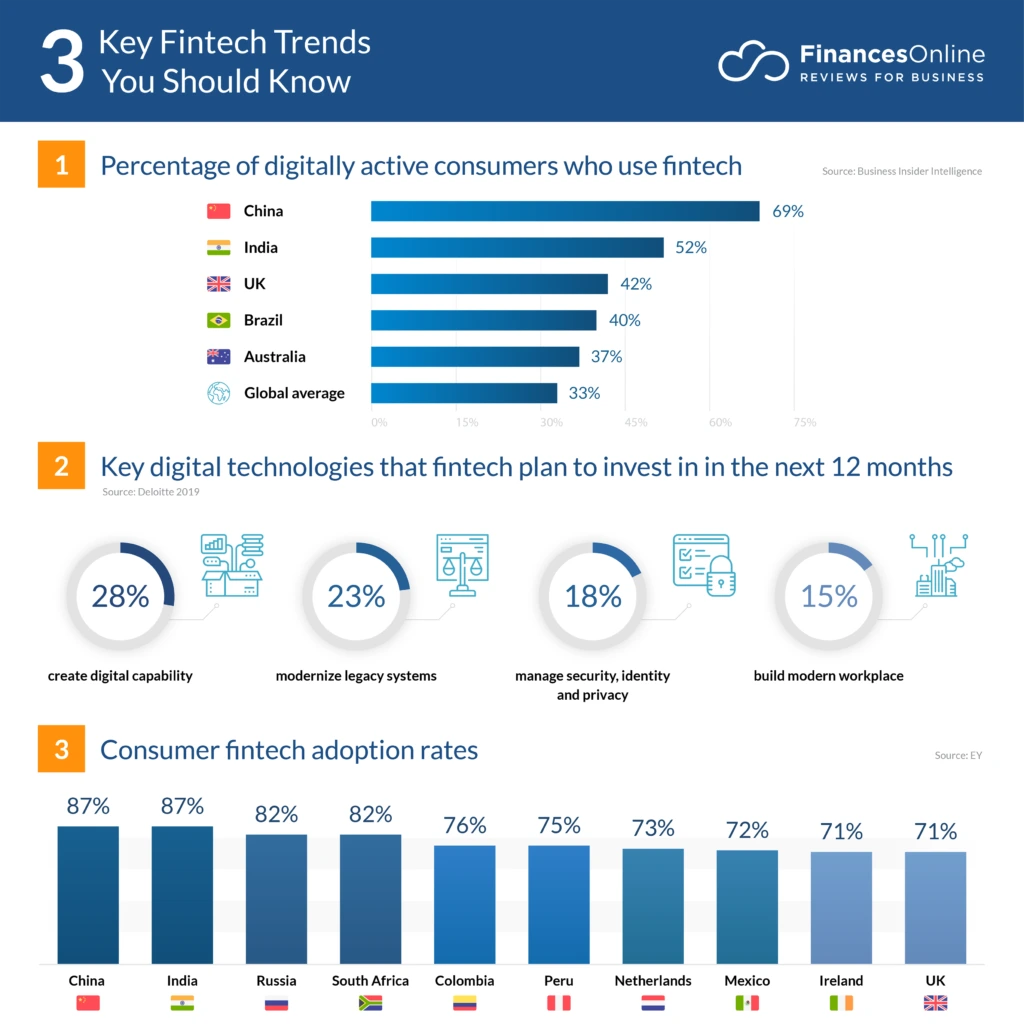

In the dynamic realm of finance, India is witnessing a revolutionary surge driven by fintech startups. These innovative companies are redefining traditional banking practices, with a particular focus on accessibility, convenience, and financial inclusion. In 2024, the landscape is ablaze with the rise of neo-banks, digital lending platforms, and a government keen on fostering a cashless economy.

Section 1: The Fintech Landscape in 2024

In the fast-paced world of Indian fintech, several trends are reshaping the industry, turning it into a unicorn breeding ground. The following are the key trends fueling this financial revolution:

1. Super Apps Rising:

Fintech giants like CRED, Paytm, and PhonePe are evolving into comprehensive financial hubs, offering a one-stop-shop for various financial services. Loyalty programs and cross-selling strategies intensify the competition for consumers’ digital wallets.

2. Beyond Payments: The Lending Boom:

2024 marks the year of lending, with companies like ZestMoney and EarlySalary democratizing credit access for underserved segments through AI-powered credit scoring and alternative data analysis.

3. Wealth Tech Takes Center Stage:

Robo-advisors such as Groww and Inveztify are gaining traction among Millennials and Gen Z, making wealth creation accessible with user-friendly interfaces and AI-driven portfolio management.

4. InsurTech: From Bricks to Clicks:

Innovative insurtech startups like Acko and Go Digit are transforming the insurance sector with on-demand, cost-effective policies and disruptive technologies such as telemedicine integration and AI-powered risk assessment.

5. Rural Fintech: Bridging the Divide:

Companies like Jana Small Finance Bank and Aye Finance are overcoming financial inclusion challenges by leveraging vernacular languages, mobile-first platforms, and agent networks.

Section 2: Challenges and Opportunities

While the fintech scene is flourishing, it’s not without its challenges. Regulatory hurdles, data privacy concerns, and cybersecurity threats pose potential risks. However, with a supportive government, a thriving tech ecosystem, and an untapped market, the opportunities for growth are immense.

Section 3: Growth Numbers and Analytics

A closer look at some key players in the Indian fintech space:

– Lendingkart:

Raised ₹200 crore debt funding, awarded as a Great Place to Work.

– Fusion Microfinance:

Achieved record-high AUM, disbursements, and profit growth of 25%+.

– Groww:

FY22 revenue at ₹351 crore, invested $3.5 million in fintech startup Nimbbl.

– Paytm:

Consistent increase in loan disbursals, with Q3FY23 reaching ₹9,958 crore.

– Poonawalla Fincorp:

FY23 profit of ₹585 crore, a 100% jump from the previous year, total AUM at ₹16,143 crore.

These numbers underscore the rapid growth and expansion of fintech startups in India, showcasing significant increases in revenue, funding, and user base.

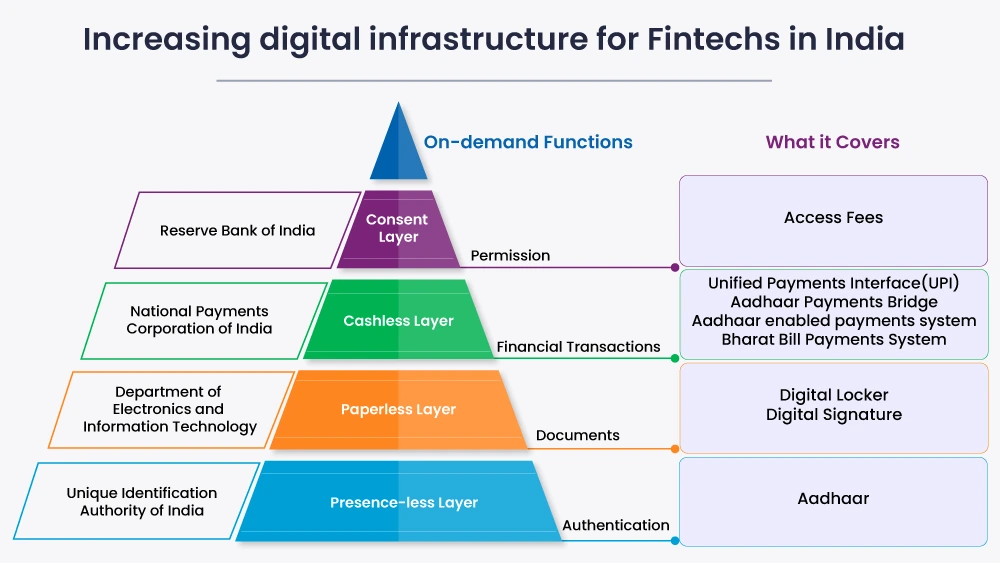

Section 4: Government’s Role in Fintech Frenzy

The Indian government has been a driving force behind the fintech frenzy. Initiatives like the Stand Up India scheme, providing over 40,000 crore in loans, and the Startup India initiative, recognizing over 1,14,902 entities as startups, have laid the foundation for success.

Regulations facilitating instant digital payments and liberalized FDI regulations have created a conducive environment for foreign investors. The government’s proactive approach has built a cozy hive for fintech startups to thrive in.

Section 5: Market Size, Investments, and Financial Inclusion

Key insights into the broader landscape:

– Government Initiatives:

Digital India campaign and Start-up India initiative.

– Market Size:

Expected to reach $3.5 trillion by 2025.

– Investments:

From 2014 to 2018, $57.2 billion invested in Indian fintech companies; in 2024, total funding reached $25 billion.

– Financial Inclusion:

Initiatives like Jan Dhan Yojana have increased bank accounts and digital payment adoption.

Conclusion: The Future of Indian Fintech

In conclusion, the Indian fintech sector is on an unprecedented growth trajectory. With a supportive government, a booming tech ecosystem, and a vast untapped market, the future holds immense promise. As we navigate through 2024 and beyond, it’s clear that the fintech wave in India is not just a trend but a transformative force shaping the financial landscape for years to come. So, buckle up, grab your smartphone, and ride the fintech wave with anticipation and excitement!

The things i have observed in terms of computer memory is the fact there are features such as SDRAM, DDR and many others, that must match up the requirements of the motherboard. If the personal computer’s motherboard is kind of current and there are no operating-system issues, changing the storage space literally normally requires under an hour. It’s among the easiest laptop upgrade procedures one can visualize. Thanks for discussing your ideas.

Thank you for another excellent post. Where else could anybody get that type of info in such an ideal way of writing? I have a presentation next week, and I am on the look for such info.

Thanks alot : ) for your post. I’d really like to comment that the price of car insurance varies from one coverage to another, due to the fact there are so many different issues which give rise to the overall cost. One example is, the model and make of the auto will have a large bearing on the price tag. A reliable outdated family motor vehicle will have an inexpensive premium than the usual flashy racecar.

I believe that a foreclosed can have a major effect on the borrower’s life. Property foreclosures can have a 8 to ten years negative affect on a applicant’s credit report. A new borrower that has applied for a mortgage or any kind of loans for instance, knows that the worse credit rating is, the more hard it is to secure a decent loan. In addition, it could possibly affect any borrower’s ability to find a decent place to lease or hire, if that gets to be the alternative property solution. Thanks for your blog post.

I am now not positive the place you’re getting your info, however good topic. I must spend a while finding out much more or figuring out more. Thanks for magnificent info I used to be looking for this info for my mission.

Interesting article. It is very unfortunate that over the last one decade, the travel industry has already been able to to take on terrorism, SARS, tsunamis, influenza, swine flu, and also the first ever real global downturn. Through all of it the industry has really proven to be robust, resilient as well as dynamic, getting new methods to deal with difficulty. There are continually fresh issues and opportunity to which the industry must just as before adapt and react.

The very crux of your writing while sounding agreeable in the beginning, did not really sit well with me personally after some time. Someplace within the paragraphs you were able to make me a believer but just for a while. I still have a problem with your leaps in logic and one might do well to help fill in those breaks. If you can accomplish that, I could surely be amazed.

I cling on to listening to the news update talk about getting boundless online grant applications so I have been looking around for the top site to get one. Could you advise me please, where could i get some?

Thanks for the helpful posting. It is also my belief that mesothelioma cancer has an particularly long latency period, which means that warning signs of the disease would possibly not emerge until finally 30 to 50 years after the first exposure to asbestos. Pleural mesothelioma, that is certainly the most common kind and is affecting the area round the lungs, will cause shortness of breath, torso pains, as well as a persistent coughing, which may cause coughing up maintain.

Thank you for sharing superb informations. Your web site is so cool. I am impressed by the details that you抳e on this site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the information I already searched everywhere and simply could not come across. What an ideal web site.